Clause 19: travelling compensation and excess travelling time

19.1 Travelling Compensation

19.1.1 Any authorised official travel and associated expenses, properly and reasonably incurred by an employee required to perform duty at a location other than their normal headquarters must be met by the Department.

19.1.2 The Secretary must require employees to obtain an authorisation for all official travel prior to incurring any travel expense.

19.1.3 Where available at a particular centre or location, the overnight accommodation to be occupied by employees who travel on official business must be the middle of the range standard, referred to generally as three star or three diamond standard of accommodation.

19.1.4 Where payment of a proportionate amount of an allowance applies in terms of this clause, the amount payable is the appropriate proportion of the daily rate. Any fraction of an hour must be rounded off to the nearest half-hour.

19.1.5 The Department will elect whether to pay the accommodation directly or whether an employee should pay the accommodation and be compensated in accordance with this clause. Where practicable, employees must obtain prior approval when making their own arrangements for overnight accommodation.

19.1.6 Subject to subclause 19.1.14 of this clause, an employee who is required by the Secretary to work from a temporary work location must be compensated for accommodation, meal and incidental expenses properly and reasonably incurred during the time actually spent away from the employee's residence in order to perform the work.

19.1.7 If meals are provided by the Government at the temporary work location, the employee is not entitled to claim the meal allowance.

19.1.8 For the first 35 days, the payment is:

(i) where the Department elects to pay the accommodation provider the employee receives:

(a) the appropriate meal allowance in accordance with Item 1 in Table 2 of Schedule 2, Part B; and

(b) incidentals as set out in Item 4 in Table 2 of Schedule 2, Part B; and

(c) actual meal expenses properly and reasonably incurred (excluding morning and afternoon teas) for any residual part day travel;

(ii) where the Department elects not to pay the accommodation provider the employee must elect to receive either:

(a) the appropriate rate of allowance specified in Item 3 in Table 2 of Schedule 2, Part B and actual meal expenses properly and reasonably incurred (excluding morning and afternoon teas) for any residual part day travel; OR

(b) in lieu of subparagraph (a) of this paragraph, payment of the actual expenses properly and reasonably incurred for the whole trip on official business (excluding morning and afternoon teas) together with an incidental expenses allowance set out in Item 3 in Table 2 of Schedule 2, Part B.

19.1.9 Payment of the appropriate allowance for an absence of less than 24 hours may be made only where the employee satisfies the Secretary that, despite the period of absence being of less than 24 hours duration, expenditure for accommodation and three meals has been incurred.

19.1.10 Where an employee is unable to so satisfy the Secretary, the allowance payable for part days of travel is limited to the expenses incurred during such part day travel.

19.1.11 After the first 35 days - If an employee is required by the Secretary to work in the same temporary work location for more than 35 days, the employee must be paid the appropriate rate of allowance as specified at Item 3 in Table 2 of Schedule 2, Part B.

19.1.12 Long term arrangements - As an alternative to the provisions after the first 35 days set out in subclause 19.1.11 of this clause, the Department could make alternative arrangements for meeting the additional living expenses, properly and reasonably incurred by an employee working from a temporary work location.

19.1.13 The return of an employee to their home at weekends, on rostered days off or during short periods of leave while working from a temporary work location does not constitute a break in the temporary work arrangement.

19.1.14 This clause does not apply to employees who have initiated working at another location.

19.2 Excess Travelling Time

19.2.1 A permanent or long-term temporary employee directed by the Secretary to travel on official business outside the usual hours of duty is entitled to apply and to be compensated for such time either by:

(i) payment calculated in accordance with the provisions contained in this subclause; or

(ii) if it is operationally convenient, by taking equivalent time off in lieu to be granted for excess time spent in travelling on official business.

19.2.2 Compensation under paragraphs 19.2.1(i) or 19.2.1(ii) of this clause is subject to the following conditions:

(i) on a non-working day - all time spent travelling on official business;

(ii) on a working day - subject to the provisions of subclause 19.2.5 of this clause, all additional time spent travelling before or after the employee's normal hours of duty;

(iii) period for which compensation is being sought is more than a quarter of an hour on any one day.

19.2.3 No compensation for travelling time is to be given in respect of travel between 11.00 pm on any one day and 7.30 am on the following day where the employee has travelled overnight and sleeping facilities have been provided for the employee.

19.2.4 Compensation for travelling time is to be granted only in respect of the time that might reasonably have been taken by the use of the most practical and economic means of transport.

19.2.5 Compensation for excess travelling time excludes the following:

(i) time normally taken for the periodic journey from home to headquarters and return;

(ii) any periods of excess travel of less than 30 minutes on any one day;

(iii) travel to new headquarters on permanent transfer, if special leave has been granted for the day or days on which travel is to be undertaken;

(iv) time from 11.00 pm on one day to 7.30 am on the following day if sleeping facilities have been provided;

(v) travel not undertaken by the most practical available route;

(vi) working on board ship where meals and accommodation are provided;

(vii) travel overseas.

19.2.6 Waiting Time

When a permanent or long-term temporary employee is required to wait for transport in order to commence a journey to another location or to return to headquarters and such time is outside the normal hours of duty, such waiting time is treated and compensated in the same manner as travelling time.

19.2.7 Payment

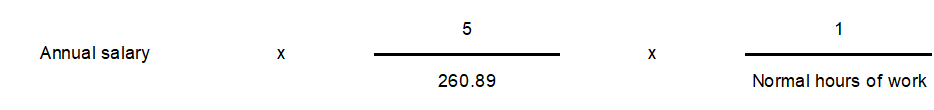

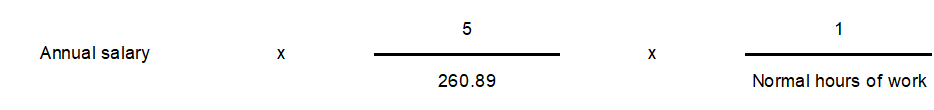

Payment for travelling time calculated according to subclauses 19.2.1 and 19.2.3 of this clause is at the employee’s ordinary rate of pay on an hourly basis calculated as follows:

19.2.8 The rate of payment for travel or waiting time on a non-working day is the same as that applying to a working day.

19.2.9 Time off in lieu or payment for excess travelling time or waiting time will not be granted or made for more than eight hours in any period of 24 consecutive hours.

19.2.10 Meal Allowances

A permanent or long-term temporary employee who is authorised by the Secretary to undertake a one-day journey on official business which does not require the employee to obtain overnight accommodation is paid the following allowances as described at Item 1 in Table 2 of Schedule 2, Part B:

(i) breakfast when required to commence travel at or before 6.00 am and at least one hour before the prescribed starting time;

(ii) an evening meal when required to travel until or beyond 6.30 pm; and

(iii) lunch when required to travel a total distance on the day of at least 100 kilometres and, as a result, is located at a distance of at least 50 kilometres from the employee’s normal headquarters at the time of taking the normal lunch break.