Vendor payment

Direction and guidance on processing payments to suppliers of NSW public schools and education support offices.

Audience

All department employees who purchase goods and/or services as part of their role or negotiate agreements with suppliers.

| Version | Date | Description of changes | Approved by |

|---|---|---|---|

| V01.0.0 | 20/06/2024 |

Under the 2023 Policy and procedure review program, new policy document with consolidated instructions previously provided in Vendor Invoice Payment Terms policy. |

Executive Director, Shared Services, EDConnect |

About the policy

These procedures relate to the Financial management policy.

These procedures comply with NSW Treasury Policy and Guidelines TPG 24-01 Management of NSW Government Payments (PDF 481 KB) and any future TPGs that supersede it.

| Term | Definition | |

|---|---|---|

EdBuy |

The department’s online marketplace. |

|

Purchasing card (PCard) |

Are credit cards and the preferred payment method for purchasing goods and services. |

|

SAP |

The department’s online finance system. |

|

TPG |

NSW Treasury Policy and Guidelines. |

|

All staff (purchasers) must:

- comply with these procedures

- comply with the NSW Government’s policies and legislation relating to purchasing

EDConnect, Shared Services Finance, Manager Accounts Payable:

- monitors the implementation of this policy

- reviews the effectiveness of this policy every 3 years

- provides quarterly reporting to the Small Business Commissioner and NSW Treasury on the department’s payment performance, which is in line with these procedures

- manages the complaints handling process.

What needs to be done

These procedures do not apply for payments to:

- travel support officers engaged by the Assisted School Travel Unit

- organisations for garnishee orders

- schools

- employees and associated employee entitlements including ATO

- petty cash accounts.

1. Determine how to pay for goods or services

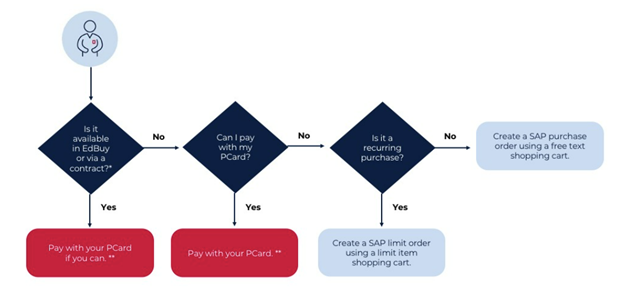

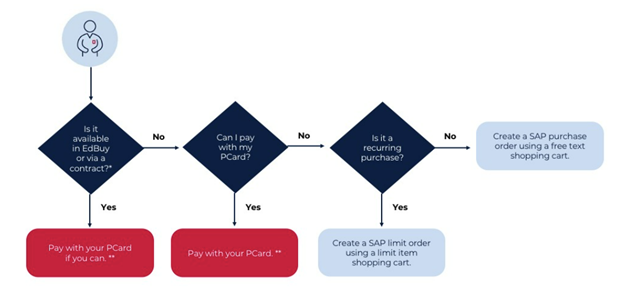

As described in Figure 1, staff should first check if the goods or services they require are available via EdBuy (the department’s online marketplace) or through the mandated contracts list or department contracts (refer to Our contract arrangements). If they are available, staff should pay with their purchasing card (PCard) where possible.

If the required goods or services are not available through EdBuy or via a contract, staff should first try to buy them using their PCard. If this is not possible, and:

- it is a one-off purchase, staff should create a SAP purchase order using a free text shopping cart

- it is a recurring purchase, staff should create a SAP limit purchase order using a limit item shopping cart.

2. Purchase goods and services

The purchasing process must comply with thethe Procurement policy (staff only) and Purchasing and procurement procedures (staff only):

- EdBuy or contract (Purchasing and procurement procedures section 2.3) (staff only)

- Purchase from other sources (Purchasing and procurement procedures section 3) (staff only)

- Engage a consultant or a major supplier (Purchasing and procurement procedures section 3.4) (staff only)

3. Pay with purchasing cards (PCard)

Purchasing cards (PCards) are credit cards and the preferred payment method for purchasing goods and services. They support the cash flow of small and medium businesses by allowing immediate payment.

Where possible, staff should use their PCards to purchase goods and services.

All card holders must follow the Purchasing card (PCard) procedures (staff only) when applying for and using PCards.

Refer to Purchasing Cards (PCards) (staff only) for more information on how to use PCards.

4. Pay with a SAP purchase order

Staff should only use a SAP purchase order to facilitate a payment when they cannot use any other payment methods.

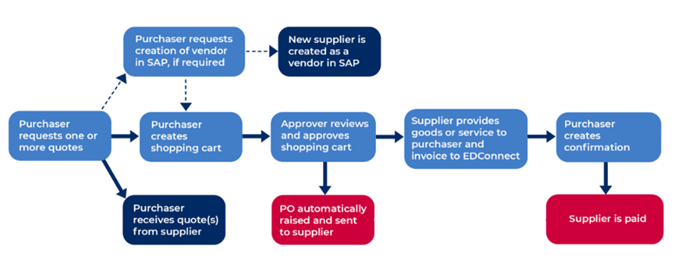

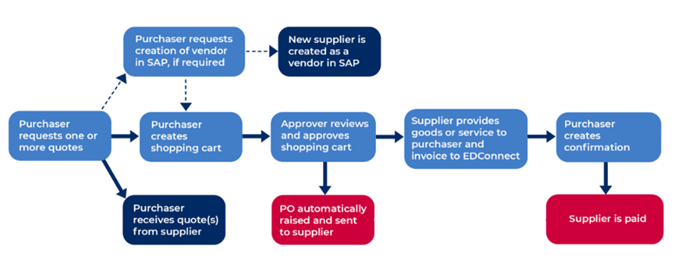

Staff must follow the steps below when creating a purchase order in SAP (as outlined in Figure 2). For more detail and quick reference guides, refer to Purchase in SAP (staff only). The purchaser:

- requests one or more quotes

- applies for the supplier to be created as vendor in SAP (as needed)

- creates a shopping cart to raise a purchase order – once the shopping cart is approved, a purchase order is automatically sent to the supplier

- after the supplier provides an invoice, creates confirmation in SAP and the supplier is paid.

4.1 Pay suppliers

Staff must set up electronic funds transfer when using a purchase order to pay a SAP supplier.

In compliance with TPG 24-01 Management of NSW Government Payments (PDF 481 KB), NSW agencies must transition all payments to digital and contactless payment channels to eliminate handling cash, cheques and money orders. This includes payments:

- to citizens, businesses or suppliers for the provision of services, refunds or rebates

- between government departments.

4.2 Change payment terms

All supplier records are to be created based on the standard payment terms of 30 calendar days, which begins from the date a correctly rendered invoice is received. Refer to the NSW Small Business Commissioner, What is a correctly rendered invoice?

To vary the standard terms, staff can modify a supplier master data record, but they will need documentation and line manager approval. Refer to Change supplier master data – QRG (staff only) for detailed steps on how to make this change.

For small businesses, changes to payment terms will occur within 2 to 6 weeks of registering their business on the NSW Government’s buy NSW Supplier Hub. This aligns with the NSW Small Business Commissioner’s Faster Payment Terms policy.

Payment terms longer than 30 calendar days from the invoice date are permitted only where the nature of the goods and services or the structure of the purchases make it impractical to require payment within 30 calendar days.

4.3 Handle supplier invoices

Suppliers must send all invoices directly to EDConnect Accounts Payable. Refer to Getting paid on time for detailed steps.

EDConnect Accounts Payable will:

- ensure all invoices contain a valid purchase order number

- will return invoices without a purchase order number to the supplier as these are non-compliant.

Suppliers can register on the NSW Government’s buy NSW Supplier Hub and submit e-invoices for faster payment and greater invoice status visibility.

Record-keeping requirements

Financial records must be retained for a minimum of 7 years after the transactions they pertain to have concluded.

Refer to State Records NSW information on Financial management for further information.

Supporting tools, resources and related information

- EDConnect - Apply for a PCard (staff only)

- EDConnect - Purchase orders (staff only)

- Procurement - EdBuy (staff only)

- Procurement - Mandated contracts list (staff only)

- Supplying to us – Getting paid on time

- NSW Treasury - TPG 24-01 Management of NSW Government Payments (PDF 481 KB)

- NSW Small Business Commissioner - Faster Payment Terms Policy

- Procurement policy (staff only)

Policy contact

The Director Shared Services Finance monitors the implementation of this procedure, regularly reviews its contents to ensure relevance and accuracy, and updates it as needed.